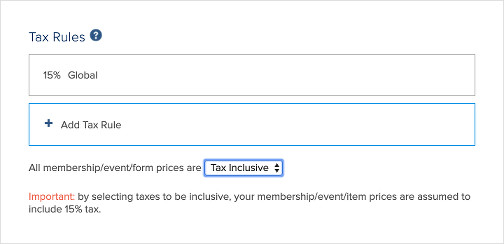

MembershipWorks now supports tax inclusive pricing. To update your preference for tax inclusive or tax exclusive pricing, please go to Organization Settings > Integration > Tax Rules.

When you select tax inclusive, all prices and taxes are calculated as if tax is included in the specified price rather than in addition to the specified price. For example, if the membership price is $10 and the tax rate is 10%, then the actual item price excluding tax is $9.09 and the tax amount is 10% * $9.09 = $0.91. In that case $9.09 (item price excluding tax) + $0.91 (tax) = $10 gross amount, which is the originally specified price.

Because MembershipWorks allows you to create multiple tax rules that apply to different geographic areas, it is important to understand how tax inclusive calculations work with tax rules:

- If you have a single global tax rule (ie. you leave the area blank), then the calculation is straightforward – all users will be charged the price as specified (which includes tax) for your membership, ticket or item, regardless of where they are located.

- If you have multiple tax rules, then prices are assumed to be the sum of the tax rates for all tax rules. For example, if you have one tax rule for 10% and another tax rule for 5%, then 15% is considered to be included in the price.

- If you have tax rules that only apply to specific areas, and if the member/user’s address falls outside that area, then the price will be adjusted to exclude non-applicable tax. For example, if you specify a tax rule of 10% for Australia, and the membership price is $10, but the member’s address is outside of Australia, then the price of membership will be adjusted to $9.09 (the $0.91 tax that is supposed to be included in the price is not applicable, so it is deducted).

If you are currently using MembershipWorks with pre-existing tax rules that are tax exclusive, here are important considerations when migrating to tax inclusive pricing:

- Existing prices are not updated automatically when switching from tax exclusive to tax inclusive. Therefore you should update the prices accordingly in your membership levels, membership add-ons, event tickets and form/carts/donation items after changing your tax calculation settings to tax inclusive.

- Any transactions that have already been processed (under tax exclusive calculations) will remain tax exclusive when you edit them.

MembershipWorks will generate tax inclusive invoices when exporting tax inclusive transactions to Xero and QuickBooks Online. If you are using QuickBooks desktop software or IIF export, please email us for more information.

Comments are closed.